If you’re considering mortgage refinancing in today’s low-interest atmosphere, check out our pros, cons, and considerations.

Large-scale home purchases were promoted in the early 2020s, and mortgage interest rates have been near historically low levels for a long period of time.

Since Freddie Mac began tabulating average annual interest rates for 30-year fixed-rate mortgages (FRMs) in 1971, interest rates have never been lower. At the time of this writing, the 30-year FRM is 3.25%. The historical maximum in 1981 was 18.63%.

In addition to opening up home purchases to more people, low interest rates also make homeowners wonder if the time is right to refinance their homes. While there are certainly compelling reasons to do so, you should carefully consider refinancing your home loan. Here’s how to find out when it’s right for you.

How Home Refinancing Works

Refinancing a mortgage means that you are applying for a new loan to repay the original loan. We will study why you might want to do this below. The refinancing process is not much different from obtaining the first home loan.

You’ll look around and compare mortgage interest rates, fees, terms, and other factors with mortgage lenders to see which one has the best deal. Your current mortgage lender may also contact you, especially if the company finds a more favorable offer than your present loan.

Why Refinance Your Home?

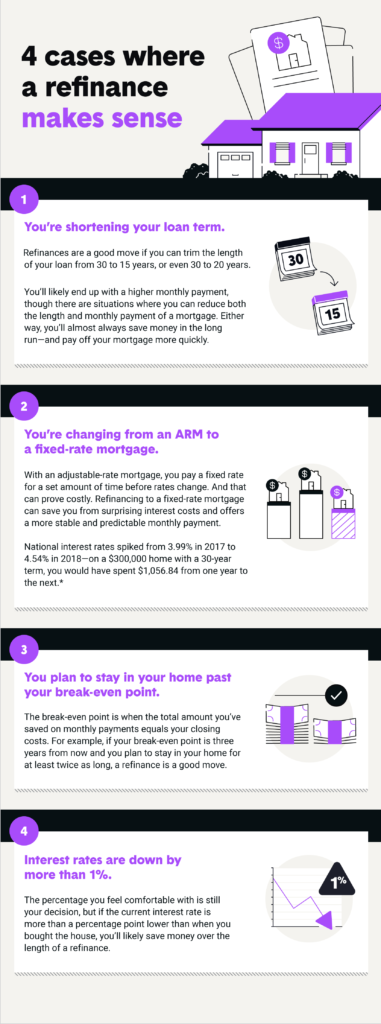

There are many reasons to refinance. Many homeowners refinance to change their mortgage term or rate type to collect large amounts of equity on the home or to reduce their interest rates and payments.

The existence of interest rates is to compensate lenders for not being able to use the funds they lent. Treat interest as a rental or lease expense for the use of the home until the mortgage is paid in full. The interest rate is applied to the principal: if the risk of the borrower appears to be higher, the lender will charge a higher interest rate.

Although the country has an average interest rate, your personal interest rate may be higher or lower. Some of the factors that determine your interest rate include your credit score, home location, price, down payment, interest rate type, loan amount, and loan type. For example, a higher credit score, a larger down payment (at least 20%), and a shorter-term generally result in lower interest rates.

Types of Home Refinancing

There are three main types of home refinance loans:

- In a rate and term refinance loan, the homeowner aims to change the interest rate and/or loan term without changing the total amount of the loan.

- In a cash-out refinance loan, the homeowner cashes out a portion of the home’s equity. This gives them a quick amount of cash-on-hand, but also likely will create a higher monthly payment and interest rate.

- In a cash-in refinance loan, the homeowner pays money to lower their new mortgage balance. This is a less common type of loan, but can help with removing private mortgage insurance or keeping your mortgage rate below a certain threshold.

Before you leap into refinancing to find a lower interest rate, take the time to research the pros and cons.

Pros of Home Refinancing

Refinancing your home can lower your monthly payments during the mortgage period. This can be accomplished by adjusting interest rates, loan terms, or both.

Use the Home Refinance Calculator to help you determine your monthly payment amount and break even. This is the amount you save in monthly payments equal to your closing costs. For example, if refinancing your mortgage reduces your monthly payment by $ 100 and the settlement cost is $ 3,600, your breakeven point is 36 months (or three years). If you plan to stay home for a long time after breaking even, mortgage refinancing can help you save money over time.

Mortgage refinancing is also a good way to change the terms of a home loan. For example, if you sign up for a 30-year fixed-rate mortgage (FRM), you may be eligible for a 20- or 15-year FRM when you refinance. Shortening the term can save tens of thousands of dollars in interest over the life of the loan and allow you to purchase a home mortgage faster. Similarly, you can switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, which improves predictability and stability and can save costs.

In cash-out refinancing, you will also receive cash when refinancing. This is useful for paying for expensive events, such as buying a car, divorce, or starting a business. However, this kind of refinancing increases the total loan amount, which may cost you in the long run. It may also reduce your home equity.

Cons of Home Refinancing

Although cost is one of the biggest advantages of refinancing, it can also be a huge disadvantage. You may be able to lower your monthly mortgage payment, but you still need to consider interest rates and transfer costs. Even if you’ve already bought a home, these costs will still exist when you refinance and typically represent 3% to 7% of your mortgage. However, these vary by lender and may include additional fees, so be sure to review all fees before submitting. This includes any prepayment penalties for the payment of existing mortgages. If you pay off the loan too quickly, some loans will charge you more.

A refinance can also add extra years and money to your mortgage through amortization, or the process of paying off debt in regular increments of interest and principal so you can fully repay the loan by the Refinancing can also add additional years and money to your mortgage through amortization (debt repayment process with periodic increases in interest and principal, so that you can pay off the loan in full before the due date). Home and auto mortgages with fixed monthly repayments charge more interest in the early stages. As the total loan amount decreases, your monthly principal payment will increase. Refinancing makes amortization effective again.

Suppose your current mortgage is a 30-year fixed-rate mortgage and your mortgage has a 5-year maturity. If you refinance with another 30-year fixed-rate mortgage, it’s like you’re starting over. Now you will spend 35 years paying for the house instead of 30 years. And depending on the interest rate, you may even spend more money than if you kept the original loan.

Finally, you must also apply and be eligible for refinancing. If you are struggling with your current mortgage, it may be difficult to obtain a new loan. The lender must conduct income and credit checks, which will add rigorous research to your credit report, which will lower your credit score by a few points. If you are looking for a mortgage within a few months, your credit score could drop after several inquiries.

Depending on the circumstances, refinancing may be a good decision, or it may end up doing more harm than good.

Here are four occasions when it might make sense to refinance your home mortgage: